Why Investors Can Be Thankful This Holiday Season

Provided by Rainer Wealth Management

As the holiday season begins, it’s the perfect time to pause and appreciate what we have, both in our personal and financial lives. This is particularly important since investors tend to focus on what could go wrong rather than what has gone right. At the moment, with markets performing well, it’s helpful to reflect on the past year to gain perspective as new challenges and opportunities emerge.

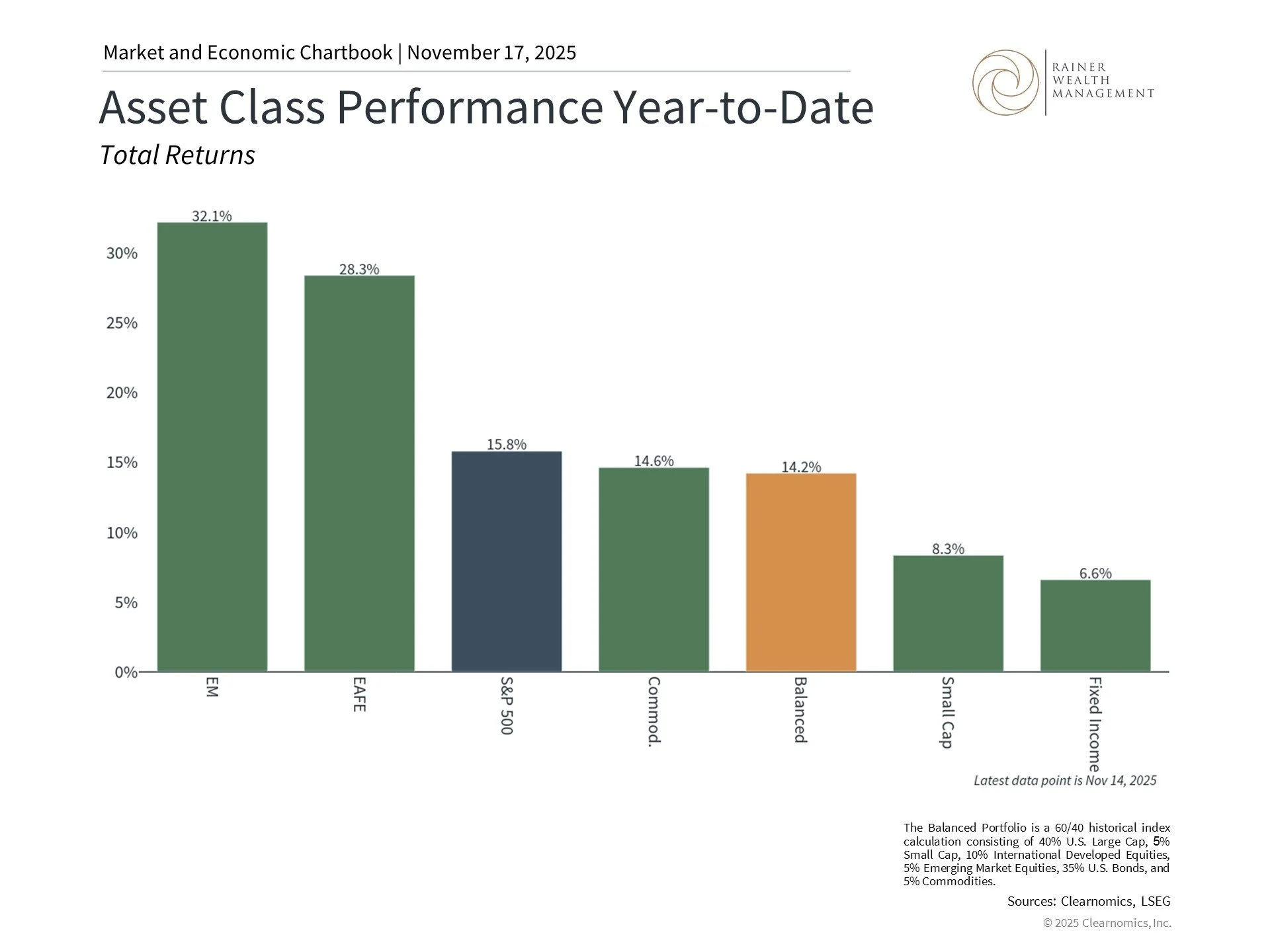

Financial markets have delivered strong returns over history, and this year has been no exception. The S&P 500 has gained over 15% with dividends year-to-date, while bonds have returned approximately 7% as measured by the Bloomberg U.S. Aggregate Bond Index. International stocks have outperformed U.S. stocks for the first time in many years. Many diversified portfolios have benefited from this broad-based performance across asset classes. What can investors keep in mind as they prepare for the coming year?

We have entered the fourth year of the bull market

This chart shows the S&P 500 price index with the start of bull and bear markets adjusted to zero. The returns for each period show the relative price returns from the start of the bear or bull market to the end of the market cycle. Bear markets are defined as declines from the prior highest market level that extend beyond -20%. Subsequent bull markets begin from each bear market bottom.

First, investors can be thankful that financial markets have performed well this year despite market swings. This bull market cycle, which began after the market bottom in October 2022, is now entering its fourth year.

While past performance is no guarantee of future results, history shows that bull markets tend to last much longer than bear markets, often running for five to ten years or more. The typical bull market has delivered cumulative returns far exceeding what we've seen so far in this cycle, despite the many challenges investors faced during those times. While there are important concerns around valuations and market concentration, investing for the long term requires us to navigate all types of market conditions.

The bond market's positive returns are important to highlight after the challenging interest rate and inflation environment of recent years. As rates have stabilized and the Federal Reserve has begun easing monetary policy again, bond prices have recovered. This demonstrates why holding both stocks and bonds remains important for portfolios in terms of both balance and income generation.

This resilience underscores an important principle: trying to time markets around short-term events is not only difficult, but can be counterproductive if not considered as part of your broader financial plan. This was true even in April when markets fell close to bear market levels as new tariffs were announced. Markets not only rebounded quickly, but rose to new all-time highs. Investors who remained disciplined were rewarded, while those who reacted to headlines may have missed opportunities and, in some cases, may still be on the sidelines.

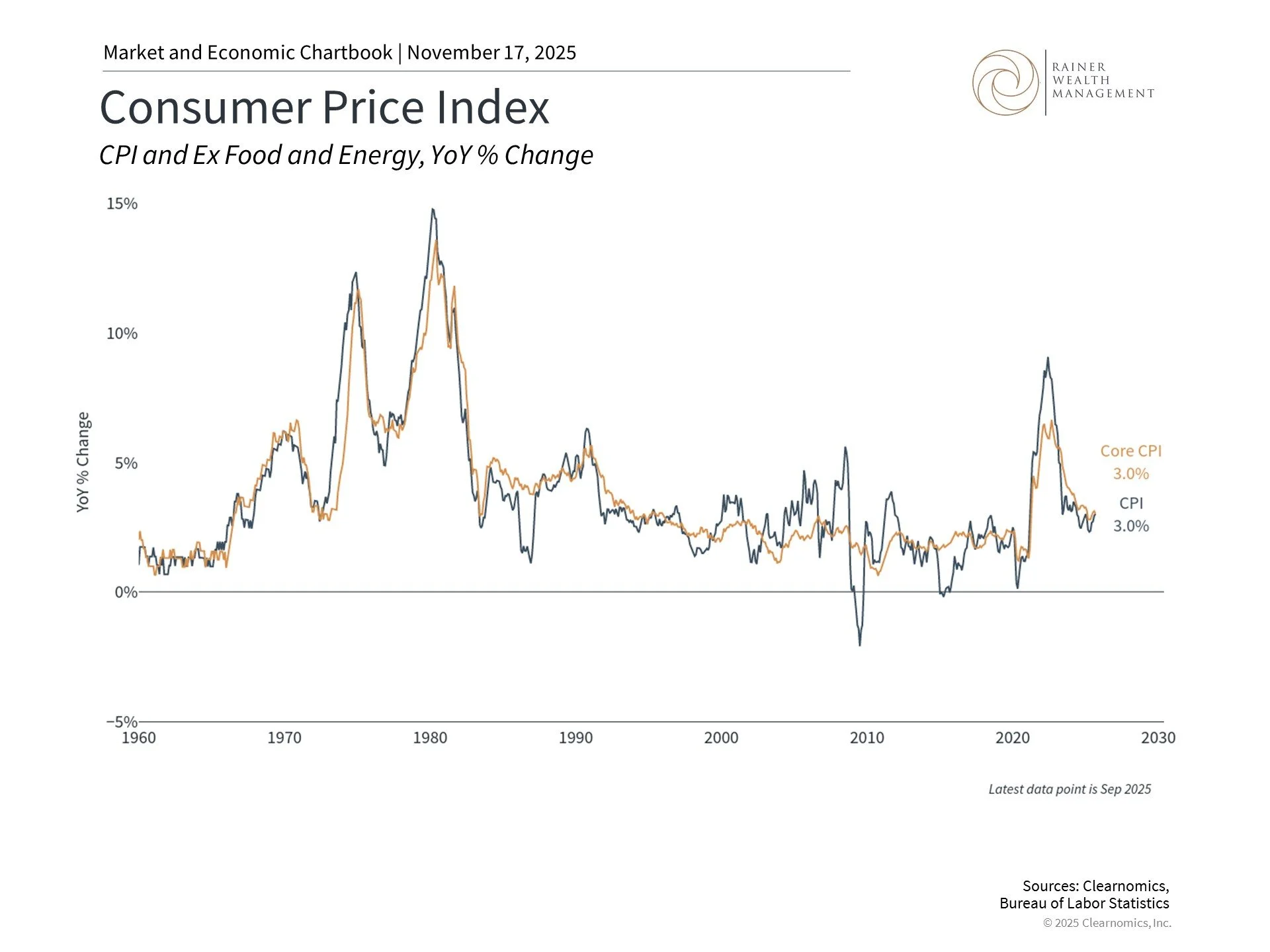

Inflation has improved and the Fed is cutting rates

This chart tracks the year-over-year changes in the Consumer Price Index (CPI) and the Consumer Price Index excluding food and energy prices (Core CPI). The CPI index measures the change in prices paid by consumers for goods and services.

Second, investors can be grateful that inflation has improved, even if progress has been slower than many would prefer. Prices have risen about 3% over the past year, which continues to be a challenge for households and policymakers. However, from an investment standpoint, inflation has been much more stable, and there are fewer fears of runaway inflation compared to prior years.

This has allowed the Fed to begin cutting interest rates after keeping them at restrictive levels for most of the year. This is also to support the job market, which has been weakening since the summer. Historically, lower rates benefit both stocks and bonds by reducing borrowing costs for businesses and consumers while making existing bonds with higher interest rates more valuable. So, even though inflation and interest rates will remain important factors for markets, fears of ever-rising inflation and interest rates appear to be behind us.

Asset allocation helps manage risk while capturing opportunities

This chart shows total asset class returns year-to-date. Asset classes included are MSCI Emerging Markets Index (EM), MSCI Developed Markets Index (EAFE), MSCI World Small Cap Index (Small Cap), S&P 500, balanced portfolio, fixed income, and MSCI World Commodity Producers Index (comm.). The balanced portfolio is a historical 60/40 portfolio consisting of 40% U.S. large cap, 5% small cap, 10% international developed equities, 5% emerging market equities, 35% U.S. bonds, and 5% commodities.

Finally, investors should also appreciate the importance of ongoing risk management and proper asset allocation. The year ahead will likely bring new sources of uncertainty just as every year does. When this happens, there will naturally be worries about recessions, bear markets, and that the cycle may be ending. Rather than reacting to every market event, long-term investors can instead hold an appropriate portfolio that can navigate different phases of the market and economic cycle.

We can also be thankful that we have different assets available to help balance risk and reward. Risk management is important at all points in an investor’s journey, and especially so after a three-year rally. The S&P 500 price-to-earnings ratio of 22.6x is above average and steadily approaching its peak dot-com levels.

Valuations do not predict what the market will do in the near-term, so this doesn't mean markets can't continue performing well. However, it does suggest that future returns could be more modest, especially when compared with cheaper asset classes and sectors. Thus, it’s important to have realistic expectations and to hold different parts of the market with more attractive valuations.

Questions about artificial intelligence will persist. It’s natural that the effect on stock prices is difficult to predict given the transformative nature of the technology. This is similar to the challenges of predicting how the internet revolution would unfold beginning in the mid-1990s. Political volatility is also likely to continue with ongoing tariff changes, geopolitical worries, the growing national debt, and more. Recent history underscores that overreacting to these events is not only counterproductive, but can derail financial plans.

The bottom line? The holiday season is an ideal time to reflect on the many reasons to be thankful and to review your portfolio allocations. A properly constructed portfolio balances the benefits of different asset classes and aligns them toward financial goals. This remains the key to navigating challenges and opportunities in the year ahead.

For more information or to schedule a consultation, please give us a call at (925) 217-4280.

Trice C. Rainer, MBA, CFP®

Elizabeth Mintzer, CFP®

390 Diablo Road, Suite 202, Danville, CA 94526

Clearnomics Partnership Disclosure: We have partnered with Clearnomics to create and distribute economic and market commentary. Material presented in economic updates encompass contributions from both Rainer Wealth Management & Clearnomics.

Securities offered through Registered Representatives of Cambridge Investment Research, a broker/dealer, Member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge, Protected Investors of America and Rainer Wealth Management are not affiliated. Registered for Securities in CA, OH, TX, WA.